The payment deferrals experience has been enhanced to allow future dated payment deferrals. Deferring any future upcoming payments will create a deferral period for the loan, pushing any future due balances to maturity date.

- You can defer past-due, current, and future due dates to the maturity date through a single API request.

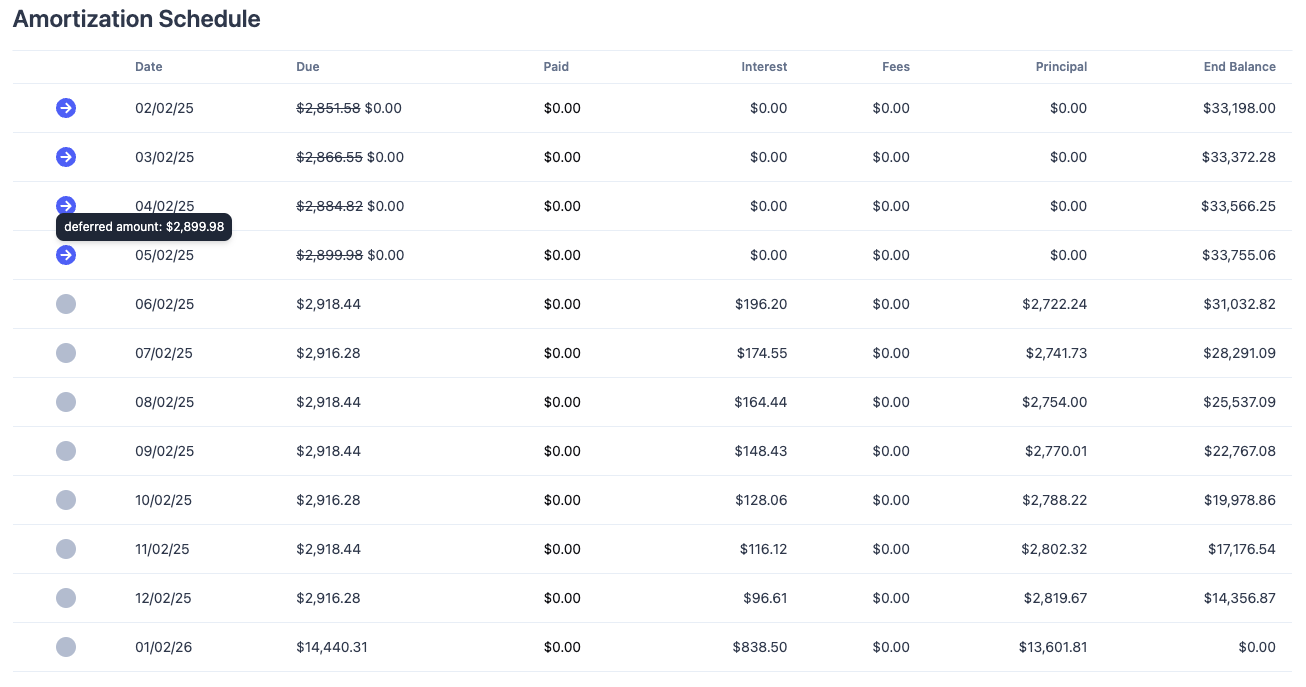

- Once any payment has been deferred, the amortization schedule in CanopyOS will update itself to communicate what amounts have been deferred, with their balances being reflected on the payment due date to which they had been deferred. An example of this is present below.

Click the link to our guide to learn more.

In the following example, the current (02/02) and future payment dates (03/02-05/02) have been deferred to the maturity date. Any due balances in the deferral period from 02/02-05/02 are now reflected as due in the maturity cycle.