Templates

Ensures that all necessary policies are applied consistently when creating accounts or credit constructs

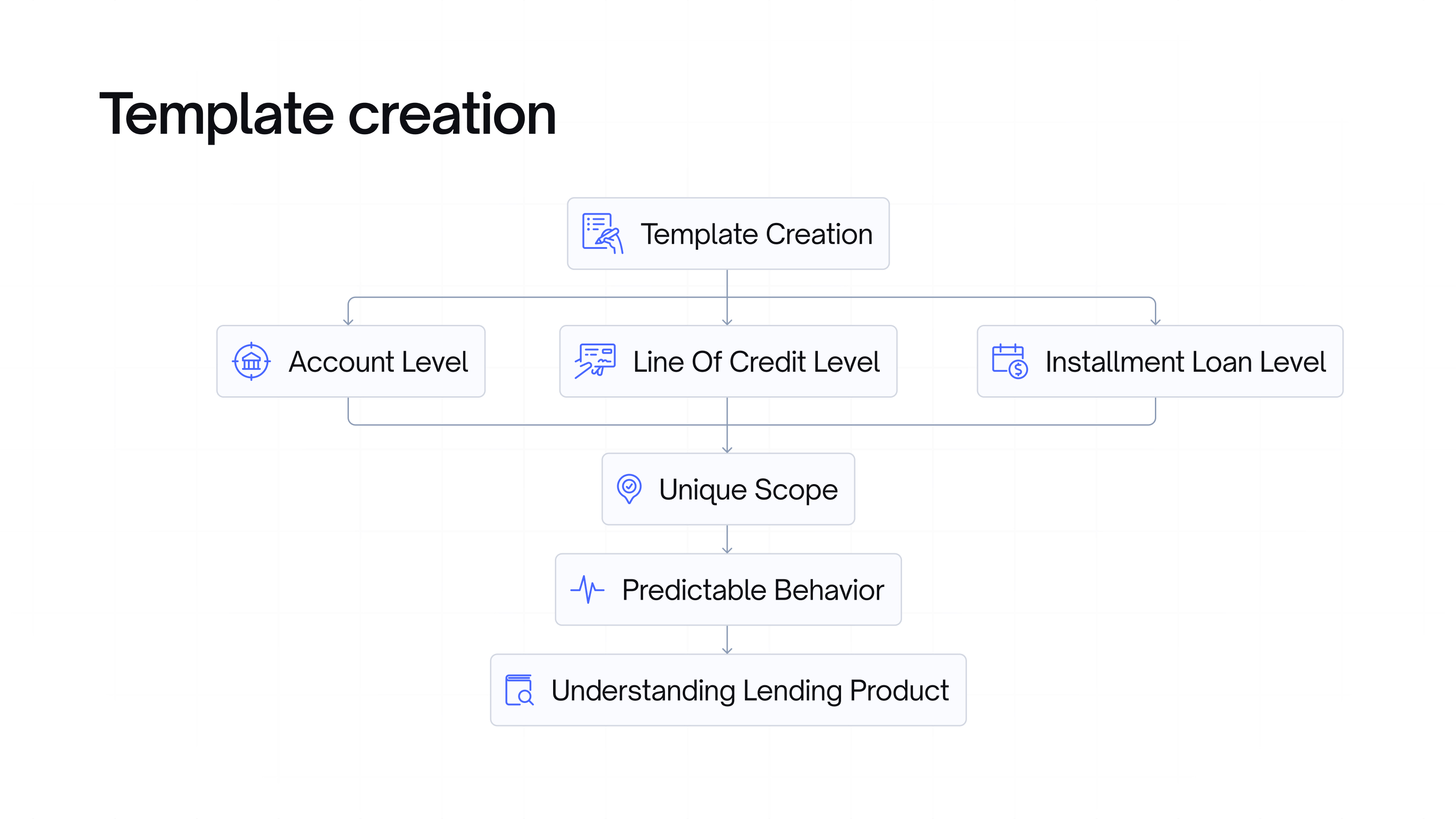

Templates sit in the middle of the hierarchy, bringing together multiple policies to define complete product behaviors. A template ensures that all necessary policies are applied consistently when creating accounts or credit constructs.

Templates must respect locale rule constraints while organizing policies into logical, reusable product definitions. When you apply a template, you're applying all its constituent policies as a cohesive unit.

Understanding Templates

Think of a template as a blueprint for your lending product. It brings together all the policies needed to create and manage financial products like credit cards, charge cards, lines of credit, or term loans. Instead of configuring individual policies each time you create a new account or loan, you can apply a template that includes all the necessary policies.

Like policies, templates are also scoped to the same entities which includes no overrides and duplication.

Pre-built Templates

Canopy provides several out-of-the-box templates to help you get started quickly:

A full list of templates available in your sandbox can be found using the get templates API for either Lines of Credit, Installment Loans or Advances

Some of which include:

- Interest only operational lines of credit with a balloon payment at maturity

- Commercial and consumer credit cards

- Charge cards

- Term loans

- Merchant cash advances

Creating Custom Templates

While our pre-built templates cover common scenarios, you can create custom templates through our API to match your specific lending program needs. Please work with our client success and client delivery teams if this is a route you'd like to pursue.

Template Management

Templates can be:

- Created and updated via API

- Versioned for tracking changes

- Applied to new or existing lending products

- Shared across your organization

Updated 3 months ago