Entities

Overview

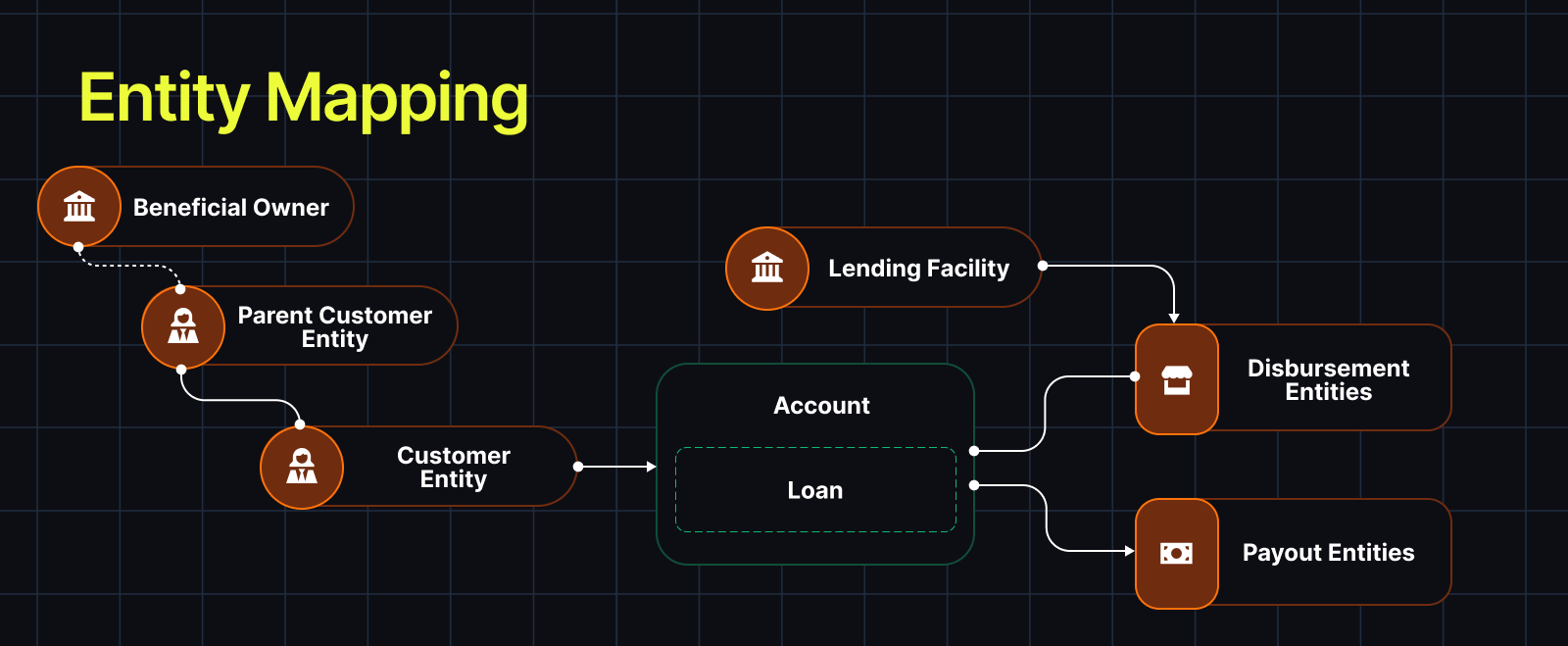

In Canopy, Entities are the individuals or businesses associated with credit or lending products. This could be a person, a business, a beneficiary, a company, a bank, or any other similar entity type. Entity records in Canopy provide critical servicing information to contextualize a loan. For instance, they are the source of truth for automating SMS or Email responses to your customers or reporting statements to credit bureaus based on activity in Canopy.

Entity records consist of identifiable information such as name, address, tax identification numbers, and other relevant information.

Entity records are created and modified purely with static data that does not drive computational behavior or policy enforcement for the lending program. For this reason, Entities in Canopy exist independently of Accounts and are linked via a many-to-many relationship.

There are a few types of Entities in our system that have specific names to help you understand their purpose:

Customer Entities

- Person Entity - A person who has access to and holds financial responsibility for a loan in Canopy.

- Business Entity - A business that holds financial responsibility for a loan in Canopy.

Treasury Entities:

- Payout Entities - The entities that receive the money from the payments that borrowers make in Canopy

- They can be Lenders, Banks, Operating Accounts or whatever your program needs

- Disbursement Entities - The entities that receive the initial funds that the loan is providing

- They can be Merchants, Suppliers, Borrowers, Lenders or whatever your program needs

- Lending Entities - the entities that send money to the Disbursement Entity

- They are typically the Lender

Here is an example of how these structures connect to each other in Canopy:

Entity Relationships

Relationships for these Entities are created by the way you input their data and what table you enter them in. Canopy allows you to understand these structures with Associated Entities. This feature helps you understand the relationship types that have been created in our system and makes managing complicated business structures easier operationally.

The types of relationships and entity titles come from the financial actions being done on Canopy. Below is an exhaustive list of the directional relationships that are made in Canopy. Today you can create Parent-Child relationships by assigning Parent Entities. You can also assign Entities to Accounts in various roles.

Below are the relationship types that can be created:

Account Relationships

Customer

- When creating a customer or account you can assign customers entities to an account

- Primary or Secondary are the two types of relationships you can give a Customer Entity when assigning it to an account

Treasury Entities

- Payout Entities, Disbursement Entities, and Lending Entities are created using Payout Entities

- The distinction comes from how you assign them to an account:

- Using the

"payouts_config"object and the"disbursements_config"on the Create an Account API call you can set these relationships - Payout Entities are assigned under the

"payouts_config"- Payout Entities receive funds from borrower payments under three main categories Principal, Interest, and Fees

- Using the

- Lending Entities and Disbursement Entities are assigned under the

"disbursements_config"- Lending Entities are the source of the funds sent out initially when the purchase is made

- Often an operating account for the lending company

- Disbursement Entities receive the funds of the initial disbursement of the principal amount that the loan originated for.

For more information on Treasury Entities go to this page: Treasury Entities

- Lending Entities are the source of the funds sent out initially when the purchase is made

Customer Entity Relationship Types

You can assign relationships between Customer Entities.

Here are the relationship types that can be created. Note these are directional names to the relationships due to the financial implications of the relationships you create in our system.

- Parent person of a child business = Owner

- Parent person of a child person = Account Holder/Account Admin

- Parent business of a child business = Holding Financial Institution/Corporation

- Parent business of a child person = Financial Sponsor/Employer

- Child person of a parent business = Controller/Account Manager

- Child person of a parent person = Authorized User

- Child business of a parent business = Subsidiary/Segment

- Child business of a parent person = Funded Entity

These relationship types are visible using Associated Entities

Please contact the Client Delivery team if you have questions about your specific use case.

Related Articles

Updated 10 months ago