x DataDirect How-to Guide (Discontinued)

From getting access to running your first SQL query

Access your credentials

Your DataDirect credentials can be retrieved via the following API call:

GET /organization/data_direct

The response will be formatted as follows:

{

"host": "***********.amazonaws.com",

"password": "**********",

"port": 5432,

"username": `

}

Connect to your preferred database client

From your preferred database querying tool, start a new PostgreSQL connection.

We recommend Postico 2 as a good free database tool if you don't have a preferred tool already.

You should be prompted with a form to enter in the credential information you received in the call you made above.

Query Your Data

Now that you have connected DataDirect to your query tool of choice and are aware of which entities you can query, you’re ready to begin building your own queries! Below are the entities available along with their related fields.

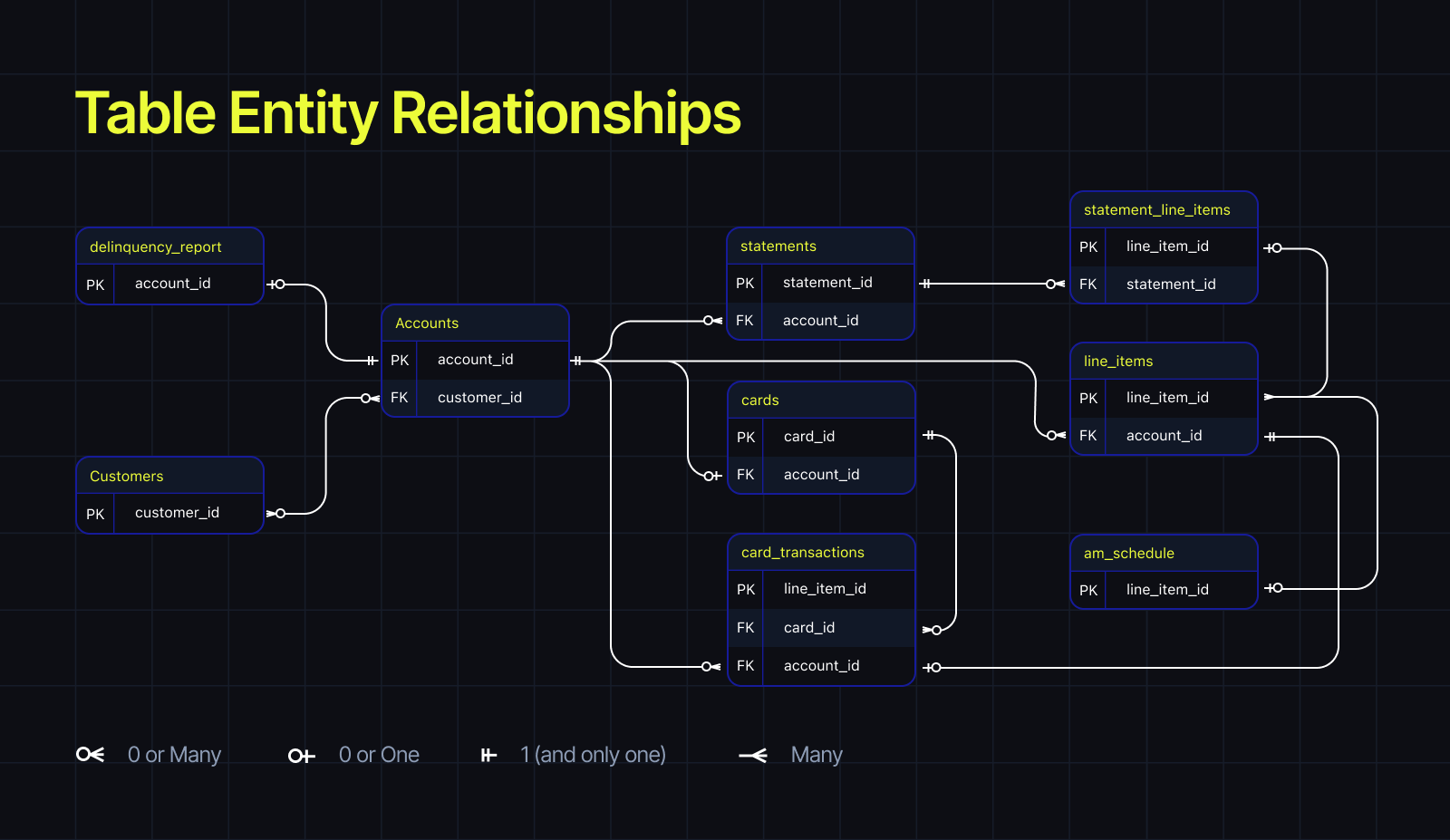

Table entity relationships

Checking data freshness

DataDirect data is typically refreshed every hour. To identify the time of the last refresh and the state it represents, you can check for the most recent related record in the refresh_history:

select

table_name,

last_updated_at

from data_direct.refresh_history;

Available Entities and Fields

As mentioned on the DataDirect page, the data structure used closely mimics the data structure surfaced from the API.

Hence, you can find a definition for each column by finding an attribute with the same name.

Customers

CustomersTo see the full table, run the following query.

select

customer_id,

external_customer_id,

address_line_one,

address_line_two,

address_city,

address_state,

address_zip,

address_country_code,

name_prefix,

name_first,

name_middle,

name_last,

name_suffix,

passport_number,

passport_country,

created_at,

updated_at,

customer_type,

external_customer_parent_id,

customer_parent_id,

is_borrower_portal_user,

is_active,

verification_status,

title,

phone_number,

ssn,

international_customer_id,

email,

date_of_birth,

customer_num_active_accounts,

customer_total_balance_cents,

customer_principal_cents,

customer_interest_balance_cents,

customer_am_interest_balance_cents,

customer_deferred_interest_balance_cents,

customer_am_deferred_interest_balance_cents,

customer_fees_balance_cents,

business_details,

bloom_metadata

from

data_direct.customers;

For more information and descriptions of each field, please see the Customer section of our API documentation.

Accounts

AccountsTo see the full table, run the following query.

select

external_account_id,

organization_id,

customer_id,

account_status,

account_status_subtype,

is_active_scra,

external_fields,

effective_at,

created_at,

updated_at,

product_id,

product_name,

product_color,

product_short_description,

product_long_description,

product_type,

close_of_business_time,

product_time_zone,

effective_close_of_business,

first_cycle_interval,

credit_limit_cents,

max_approved_credit_limit_cents,

min_pay_type,

initial_principal_cents,

interest_grace_method,

product_late_fee_cents,

late_fee_cents,

late_fee_cap_percent,

late_fee_grace,

payment_reversal_fee_cents,

payment_reversal_fee_cap_percent,

product_payment_reversal_fee_cents,

origination_fee_cents,

origination_fee_percent,

is_origination_fee_lesser_value,

is_origination_fee_amortized,

year_fee_cents,

month_fee_cents,

promo_purchase_window_inclusive_start,

promo_purchase_window_exclusive_end,

promo_purchase_window_len,

promo_inclusive_start,

promo_exclusive_end,

promo_impl_interest_rate_percent,

promo_len,

product_promo_len,

promo_default_product_interest_rate,

promo_default_product_len,

is_promo_interest_deferred,

product_promo_interest_rate,

loan_end_date,

post_promo_len,

post_promo_inclusive_start,

post_promo_exclusive_end,

post_promo_impl_interest_rate_percent,

post_promo_default_product_interest_rate,

post_promo_default_product_len,

product_post_promo_len,

product_post_promo_interest_rate,

interest_accrual_interval,

loan_discount_cents,

loan_discount_at,

recurring_fee_interval,

recurring_fee_amount_cents,

initial_delay_offset,

is_fee_interval_floored,

recurring_fee_label,

principal_balance_cents,

amortization_deferred_interest_balance_cents,

amortization_interest_balance_cents,

available_credit_cents,

deferred_interest_balance_cents,

fees_balance_cents,

interest_balance_cents,

open_to_buy_cents,

total_balance_cents,

total_paid_to_date_cents,

total_interest_paid_to_date_cents,

total_payment_supertype_to_date_cents,

total_original_amount_cents,

total_principal_original_amount_cents,

interest_rate_percent,

total_payoff_cents,

min_pay_due_at,

min_pay_cents,

unpaid_min_pay_cents,

current_min_pay_cents,

min_pay_fees_cents,

statement_min_pay_cents,

statement_min_pay_due_at,

statement_min_pay_charges_principal_cents,

min_pay_loans_principal_cents,

statement_min_pay_interest_cents,

statement_min_pay_deferred_interest_cents,

statement_min_pay_amortization_interest_cents,

statement_min_pay_amortization_deferred_interest_cents,

statement_min_pay_fees_cents,

statement_unpaid_min_pay_cents,

statement_current_min_pay_cents,

statement_cycle_payments_cents,

statement_previous_min_pay_cents,

default_payment_processor_method,

autopay_enabled,

ach_payment_processor_name,

ach_token,

ach_last_four,

debit_card_payment_processor_name,

debit_card_token,

debit_last_four,

credit_card_payment_processor_name,

checkout_dotcom_token_source_id,

checkout_dotcom_token_card_token,

checkout_dotcom_token_last_four,

checkout_dotcom_token_expires_on,

canopy_nacha_bank_routing_number,

canopy_nacha_bank_account_number,

canopy_nacha_bank_account_type,

payouts_config,

issuer_processor_details,

disbursement_source_payout_entity_external_id,

payout_entities,

payment_processor_config,

partner_entity,

attributes,

plaid_access_token_valid,

plaid_account_id_valid,

plaid_check_balance_enabled,

bloom_metadata

from

data_direct.accounts;

For more information and descriptions of each field, please see the Accounts section of our API documentation.

Line_items

Line_itemsTo see the full table, run the following query.

select

line_item_id,

external_line_item_id,

product_id,

account_id,

effective_at,

created_at,

updated_at,

valid_at,

line_item_status,

line_item_type,

description,

allocation,

original_amount_cents,

balance_cents,

principal_cents,

interest_balance_cents,

am_interest_balance_cents,

am_fees_balance_cents,

deferred_interest_balance_cents,

am_deferred_interest_balance_cents,

total_interest_paid_to_date_cents,

merchant_id,

merchant_name,

merchant_mcc_code,

merchant_phone_number,

external_fields,

line_item_relationships

from

data_direct.line_items;

For more information and descriptions of each field, please see the Line Items section of our API documentation.

Am_forecast_public

Am_forecast_publicTo see the full table, run the following query

SELECT line_item_id,

cycle_exclusive_end,

min_pay_due_at,

am_min_pay_due_cents,

am_cycle_payment_cents,

am_interest_cents,

am_deferred_cents,

am_principal_cents,

am_fees_cents,

am_start_principal_balance_cents,

am_end_principal_balance_cents,

am_start_total_balance_cents,

am_end_total_balance_cents,

paid_on_time

FROM data_direct.am_forecast_public;

For more information and descriptions of each field, please see the Amortization Schedule section of our API documentation.

Statements

StatementsTo see the full table, run the following query

select

statement_id,

external_statement_id,

effective_at,

account_id,

account_promo_purchase_window_inclusive_start,

account_promo_purchase_window_inclusive_end,

account_promo_inclusive_start,

account_promo_inclusive_end,

account_status,

account_status_subtype,

account_payout_entities,

credit_limit_cents,

total_charges_cents,

available_credit_cents,

open_to_buy_cents,

min_pay_cents,

min_pay_due_at,

min_pay_charges_principal_cents,

min_pay_loans_principal_cents,

min_pay_revolving_principal_cents,

min_pay_interest_cents,

min_pay_deferred_cents,

min_pay_am_deferred_interest_cents,

min_pay_am_interest_cents,

min_pay_fees_cents,

min_pay_am_fees_cents,

min_pay_past_due_interest_cents,

min_pay_past_due_deferred_cents,

previous_min_pay_cents,

unpaid_min_pay_cents,

current_min_pay_cents,

min_pay_floor_excess_cents,

cycle_inclusive_start,

cycle_exclusive_end,

cycle_length_days,

cycle_charges_cents,

cycle_loans_cents,

cycle_charge_returns_cents,

cycle_refunds_cents,

cycle_payments_cents,

cycle_payment_reversals_cents,

cycle_debit_adjustments_cents,

cycle_credit_adjustments_cents,

cycle_total_credits_cents,

cycle_interest_cents,

cycle_deferred_interest_cents,

cycle_am_deferred_interest_cents,

cycle_am_interest_cents,

cycle_total_interest_cents,

cycle_late_fees_cents,

cycle_fees_total_cents,

cycle_payment_reversals_fees_cents,

cycle_waived_deferred_interest_cents,

charges_principal_cents,

loans_principal_cents,

principal_balance_cents,

interest_balance_cents,

deferred_interest_balance_cents,

am_deferred_interest_balance_cents,

am_interest_balance_cents,

fees_balance_cents,

total_balance_cents,

previous_total_balance_cents,

expected_remaining_payment_amount_cents,

total_payoff_cents,

inception_to_date_payments_total_cents,

inception_to_date_purchases_total_cents,

inception_to_date_credits_total_cents,

inception_to_date_credits_and_payments_total_cents,

inception_to_date_interest_total_cents,

inception_to_date_fees_total_cents,

inception_to_date_interest_prior_total,

year_to_date_interest_total_cents,

year_to_date_fees_total_cents

from

data_direct.statements;

For more information and descriptions of each field, please see the Statements section of our API documentation.

Statement_line_items

Statement_line_itemsTo see the full table, run the following query

select

line_item_id,

external_line_item_id,

statement_id,

product_id,

effective_at,

created_at,

valid_at,

line_item_status,

line_item_type,

description,

allocation,

original_amount_cents,

balance_cents,

principal_cents,

interest_balance_cents,

am_interest_balance_cents,

am_fees_balance_cents,

deferred_interest_balance_cents,

am_deferred_interest_balance_cents,

total_interest_paid_to_date_cents,

merchant_id,

merchant_name,

merchant_mcc_code,

merchant_phone_number,

external_fields

from

data_direct.statement_line_items;

For more information and descriptions of each field, please see the Statement Line Items section of our API documentation.

Cards

CardsTo see the full table, run the following query

SELECT

card_id,

external_card_id,

account_id,

spend_limit,

token,

card_program_token,

last_four,

card_type,

state,

memo

FROM data_direct.cards;

For more information and descriptions of each field, please see the Cards section of our API documentation.

Card_transactions

Card_transactionsTo see the full table, run the following query

SELECT

card_transaction_id,

external_card_transaction_id,

card_id,

line_item_id,

issuer_processor,

attributes

FROM data_direct.card_transactions;

Pre-built reports

Pre-built reports within DataDirect are reports common to lending operations that we have pre-written the SQL and surfaced in table form for ease of use.

It’s important to note that because these are strictly pre-written and run SQL queries, they are distinctly different than the other entities within DataDirect.

Past_due_report (a.k.a. delinquency_report)

Past_due_report (a.k.a. delinquency_report)This report strictly queries your data to find the oldest cycle due date that has not yet been paid in full. It uses this information along with the current date and time of execution to calculate the number of days past due.

Given this information, its important to note that the Past_due_report (previously known as delinquency_report) does not take into consideration account sub-statuses (such as Delinquent), late fee grace periods, or any other operationally defined workflows that you may have in place.

Naming Deprecation

In an effort to reduce the possible confusion cased by the conflation of these terms, we will soon be deprecating the

delinquency_reportname in favor of more aptly naming it thepast_due_report.

SELECT

organization_id,

external_account_id,

delinquency_bucket,

days_past_due,

cure_payment_cents,

stabilization_payment_cents,

minimum_payment_due_date timestamptz,

delinquent_as_of_date timestamptz

FROM data_direct.delinquency_report;

Field Definitions

organization_id: Unique ID value associated with your organization.account id: Unique ID value of the related account.days_past_due: number of days since the oldest statement in which the minimum due balance was not paid in full.delinquency_bucket: derived from days past due.

Possible values: ‘Current’ (for not delinquent), 0-29, 30-59, 60-89, 90-119, 120-149, 150-179, 180cure_payment_cents: amount needed to completely exit delinquency.stabilization_payment_cents: amount needed to maintain current delinquency level; this is the oldest minimum payment minus the payments made since then.minimum_payment_due_date: The most recent statement’s minimum payment due date.

delinquent_as_of_date: The oldest missed payment due date for the account.

NACHA_entries

NACHA_entriesThis table is relevant for customers who use Canopy NACHA payment processor payment processor

SELECT

nacha_entry_id,

external_nacha_entry_id,

subject_account_id,

external_subject_account_id,

external_subject_line_item_id,

nacha_file_reference_code,

receiving_identification_number,

created_at

FROM data_direct.nacha_entries;

For more information and descriptions of each field, please see the NACHA section of our API documentation.

Updated over 1 year ago