Borrower Portal

Borrower Portal offers a flexible and powerful tool to deliver a customized borrower experience, allowing users to customize branding, choose specific features, and tailor the language used for communication with borrowers, while also providing views for loan information and tools for managing loan repayments.

A Customized Borrower Experience

Borrower Portal has the flexible and powerful tooling to deliver a customized borrower experience faster, with less fuss.

Your borrower portal, your branding

Canopy Borrower Portal seamlessly blends with your existing software and your brand, supporting custom stylesheets to alter the look and feel of every view and every line of text, ensuring your customers feel right at home.

Show only the features you need

Canopy Borrower Portal uses a modular low-code configuration system to present a highly customizable user experience with only the features you care about. You have control of what content is or isn't shown on each page.

Speak a language your borrowers understand

Every business is unique, and so is the language you use with your borrowers. Every line of copy in Borrower Portal can be customized to your business.

Borrower Portal Features

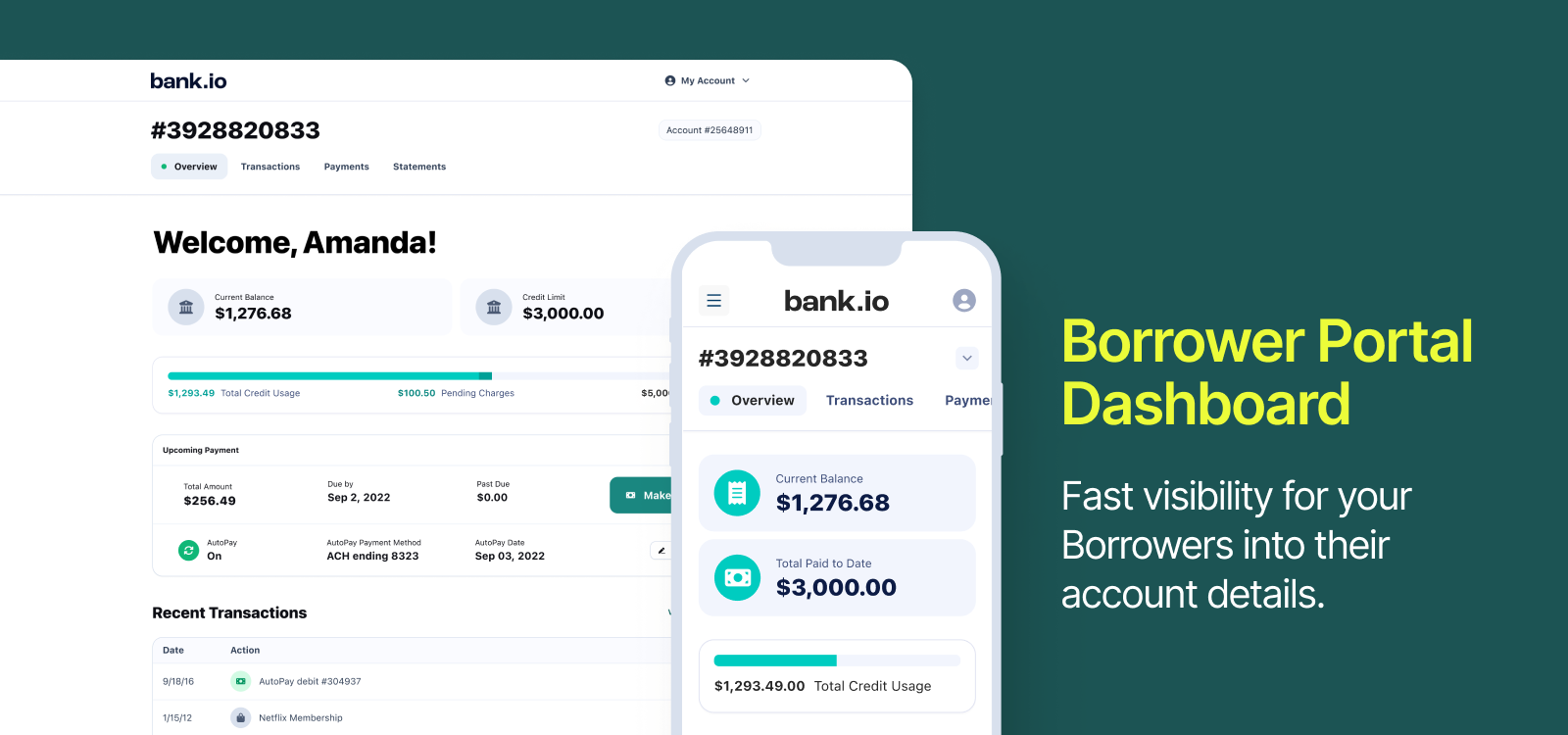

Dashboard

The dashboard summarizes upcoming payments due, autopay status, and account details. From here, borrowers can further explore their accounts by clicking on the account detail cards. Note that the specific layout and components rendered will differ from the example screenshot below depending on your organization's plugins setup.

Loan Details

The loan overview provides the most pertinent details of a borrower's loan account depending on the account product, such as their current balance, minimum payment due, and original principal.

The Upcoming Payment card in this view provides further details about the next payment due for this loan, as well as quick links to make payments and manage autopay settings.

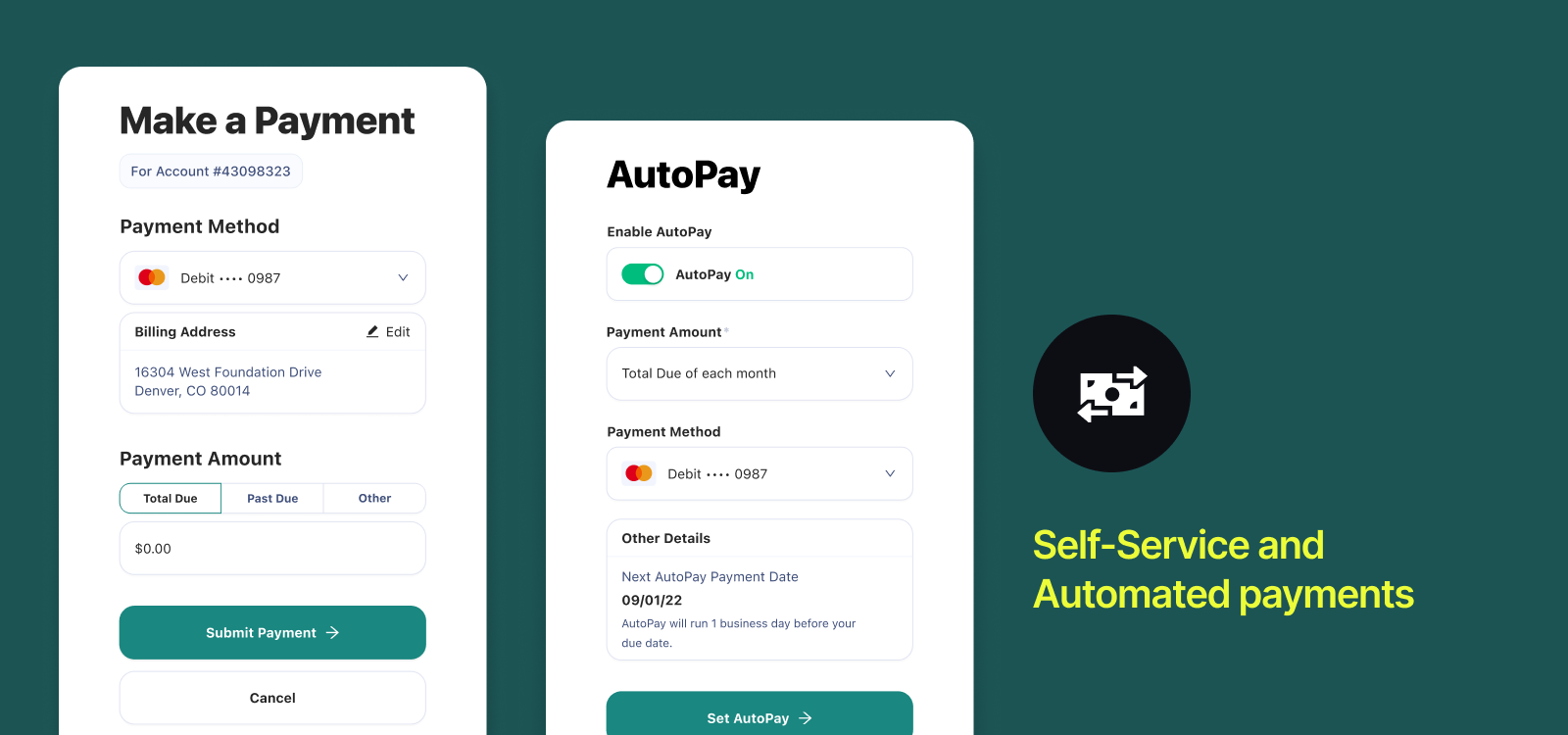

Payments

The payments view allows simple self-service management of payment methods and making manual payments. Payment method details are safely stored through your organization's configured payment processor and payments can be made quickly and securely through that processor from this view.

AutoPay

The AutoPay view allows the borrower simple self-service management of payment methods and enabling or disabling automatic payments. The upcoming payment amounts and due dates are highlighted here for ease of reference.

Profile

Your borrower can update their personal details simply through the "My Profile" view accessible through the menu at the top right. As with other fields in Borrower Portal, these profile fields can be individually enabled or disabled via plugin.

Section Articles

Updated 9 months ago