LoanLab How-to Guide

Walkthrough of how to use LoanLab.

How it Works Overview

1. Create an Account

Choose a product to onboard the account with then choose your account-level policies.

2. Choose Actions

After setting up your simulation account, you can choose actions to occur at specific times from the Action Timeline.

3. View Account

After setting up your simulation account, you can choose actions to occur at specific times from the Action Timeline.

LoanLab Demo

Accessing LoanLab

LoanLab is intended for simulating, experimenting, and testing, so it can be found in the CanopyOS menu of your UAT environment - you will not find LoanLab in your production environment.

Not sure what your UAT environment address url is?Generally, it’s in the following format: https://[your_company_name]-uat.us.canopyservicing.com/

If you’re still having trouble finding it, reach out to us at [email protected].

1. Create an Account

The first thing we need to do is configure our simulation account.

To do this, simply start by choosing the product you want to associate with the account.

You’ll then be presented with a number of account-level inputs. We’ve defaulted these inputs for your convenience, but you may choose to fill in all or none of them.

All account level configuration inputs are optional; if not provided, they will default to the product level configuration.

Account Setup Inputs

| LoanLab Input Name | Canopy API POST /account Property |

|---|---|

| Account Name | account_id |

| Open Date | effective_at |

| Loan Amount | initial_principal_cents |

| Credit Limit | credit_limit_cents |

| Interest Rate | If Installment: post_promo_impl_interest_rate_percent If Revolving: promo_impl_interest_rate_percent |

| Loan Length | post_promo_len |

| First Cycle Interval | first_cycle_interval |

| Late Fee Amount | late_fee_cents |

| AutoPay | autopay_enabled |

| Late Fee Grace Period | late_fee_grace |

| Origination Fee | origination_fee_cents or origination_fee_percent |

| Amortize Origination Fee? | is_origination_fee_amortized |

| Recurring Fees | recurring_fees |

| Recurring Fees > Fee Name | recurring_fee_label |

| Recurring Fees > Interval | recurring_fee_interval |

| Recurring Fees > Amount | recurring_fee_amount_cents |

| Recurring Fees > Delay Fee By | initial_delay_offset |

| Strict Payment | min_pay_applicable_credit_type = ‘STRICT_PAYMENT’ |

2. Setup the Action Timeline

After account setup, you’ll be taken to a page that should look familiar to you - the CanopyOS account view- with one main difference, there will be an Action Timeline drawer open.

The Action Timeline is where you can set up what you want to happen over the course of the account’s lifecycle.

The Action Timeline will be pre-populated with Cycles and Automated Actions, such as Statement Generation.

Cycles

The Action Timeline will be pre-populated with the account’s cycles based on the product selection and account policy inputs from step one.

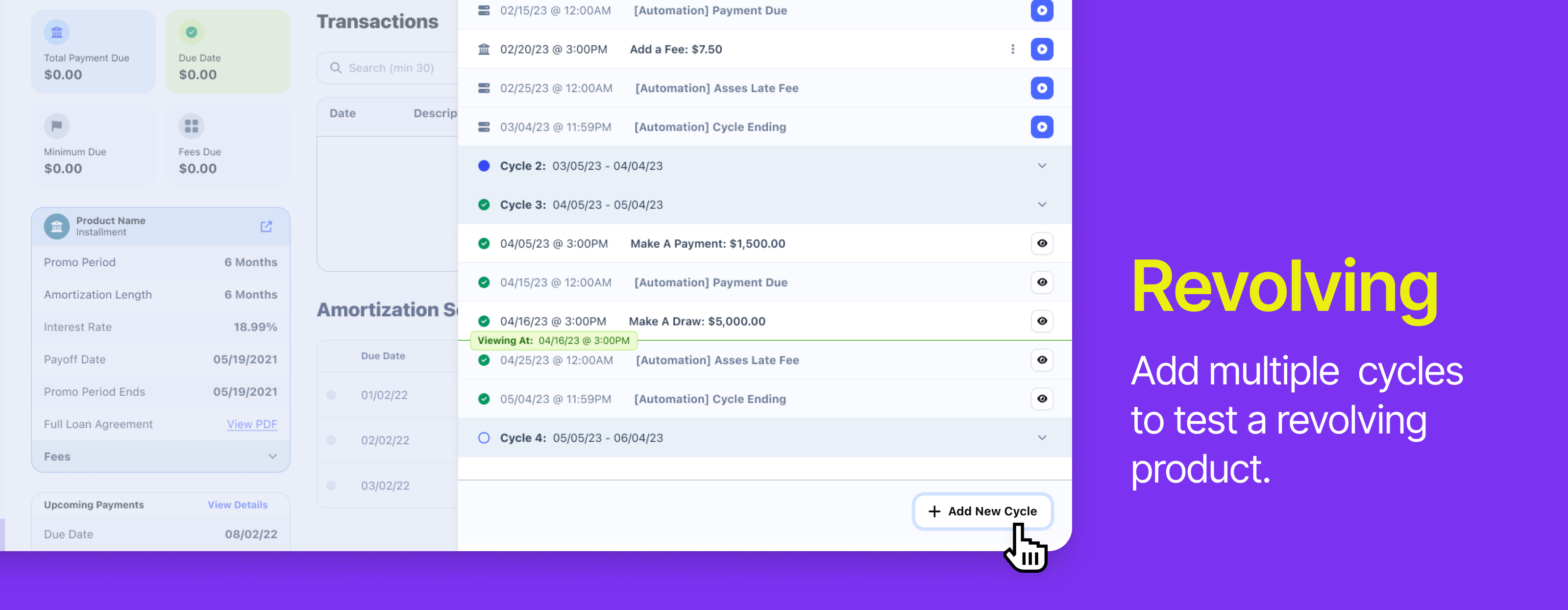

Revolving Cycles

Because revolving products do not have a set term length, if you are using a Revolving product type, LoanLab will add 4 cycles by default.

You can add additional cycles at any time by clicking the “Add a Cycle” button from the Action Timeline footer.

Actions

Within LoanLab, Actions represent events that can occur on an account over its lifecycle.

Automated Actions

The Action Timeline is pre-populated with a few items labeled with [Automation].

These are actions that the system automatically takes based on your policies and configurations.

Automated Action Name | Description |

|---|---|

[Automation] Account Created | The date and time the account was configured to be effective. |

[Automation] Generate Statement | The exact point the cycle ends and the statement data is generated. |

[Automation] Assess Late Fee | The point in time Canopy’s system will assess whether or not a late fee needs to be applied to the account based on if the minimum payment due for that cycle was made in full on time. Note: This is may not be the same time the payment is due if you have configured to allow for a late fee grace period. |

[Automation] AutoPay | If autopay is enabled on the account, this is the Action in which autopay will trigger on the account. |

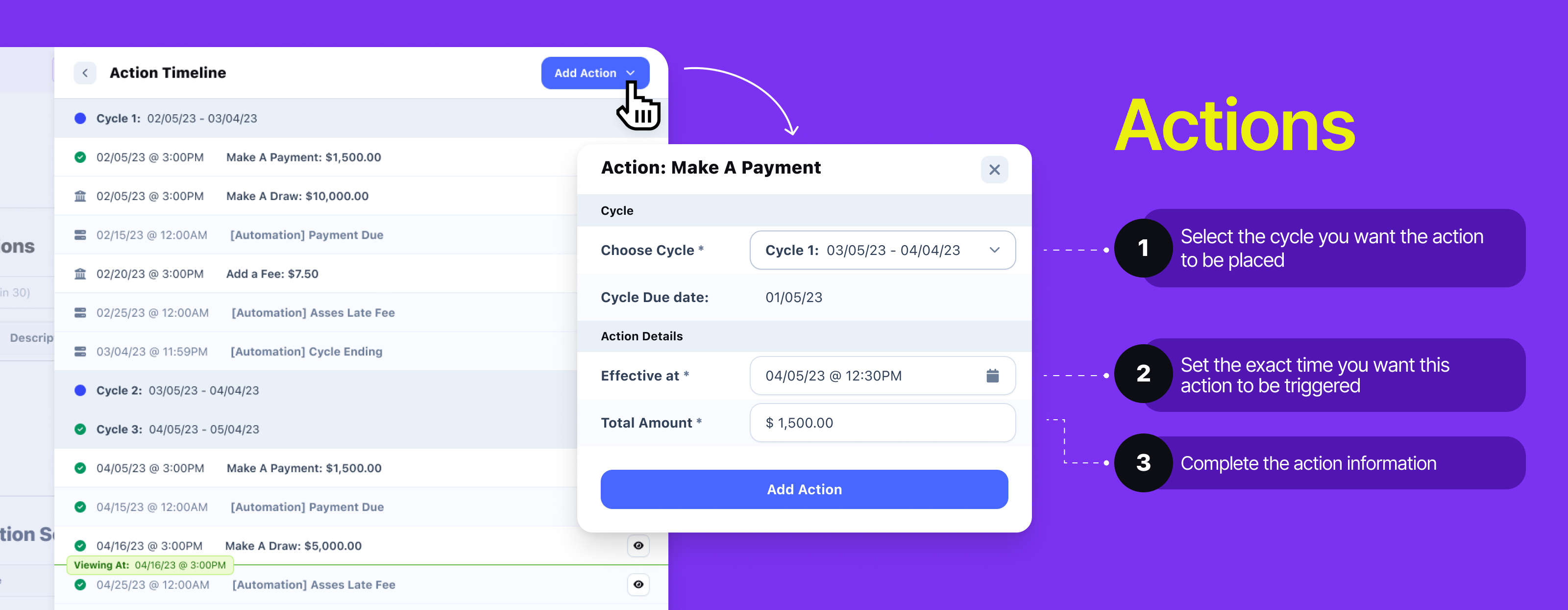

Adding Actions

You can add additional actions to the account’s lifecycle by clicking on Add Action from the Action Timeline.

List of Actions

You can add additional actions to the account’s lifecycle by clicking on Add Action from the Action Timeline.

Name | Description |

|---|---|

Make a Payment | Simulates a borrower making a payment on their account. |

Create Fee | Simulates a manual fee being added to the account. |

Create Refund | Simulates a refund transaction. |

Create Charge | Simulates a charge being added to an account. |

Create Offset | The Create Offset action will allow you to select whether you want to add an offset that will increase or decrease the account balance. Offsets can be applied to interest, principal, or fees. Selecting Increase will create a credit offset. 🔗 Related API Endpoint → Selecting Decrease will create a debit offset. 🔗 Related API Endpoint → |

Update Line Item Status | Simulates updating the line item status of a particular line item that was previously added. |

Update Interest Rate | Simulates updating the interest rate set on an account. |

Update Late Fee | Simulates updating the interest rate set on an account. |

Update Credit Limit | Simulates updating the credit limit on an account. |

Update Account Status | Simulates updating the status and sub-status of an account. |

Create Loan | Simulates adding a new loan to the account. |

Restructure Loan | Simulates the restructuring of a loan. A Create Loan action must have already been added to the timeline and played. |

Navigating the Action Timeline

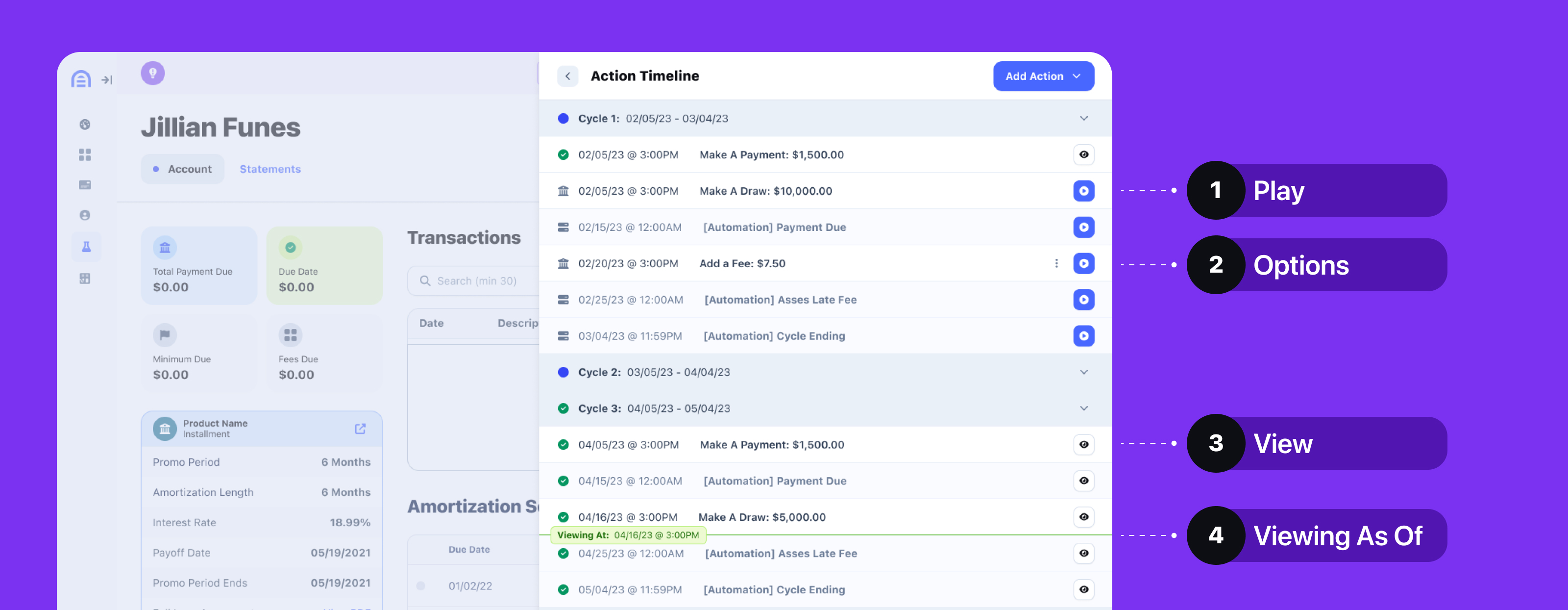

1. Play

Click on the Play button to apply an action to the account and move the account forward to that point in time.

Once an action has been played, you cannot modify the timeline prior to the action played, but you can add future actions.

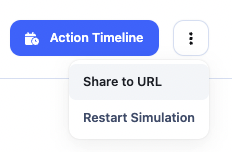

2. Options

Click on the three dots next to an unplayed action to edit or delete them.

3. View

Use the View button to quickly go back and forth to view the state of the account as it was in a previous point in time.

4. Viewing As Of

The green “Viewing As Of” indicates the current point in time to Account View is showing.

3. View the Account

To view the current state of your account from the last played action in your timeline, simply click outside of the Action Timeline at any point.

This screen is meant to replicate the CanopyOS account view as closely as possible, providing you with an accurate representation of what you can expect to see from an account going through a similar lifecycle in production.

Similar to the Action Timeline, you can find the Viewing As Of indicator in the top right-hand corner of the account view to let you know at which point in time the account is showing.

Options Menu

Clicking on the 3 dots next to the Action Timeline button will open the options menu.

Restart Simulation

This option will take you back to the Account Setup page to start over.

Share to URL

This option will copy a shareable URL to your clip board. When you navigate to this URL, your entire scenario will reload, meaning the following will happen:

- A new simulation account will be created with the same settings you chose for the original.

- Any Actions you had added to the original timeline will be pre-populated on the new simulation account in an unplayed state allowing you to play through them as is or modify the timeline.

Use Cases

Using the sharable URL feature in LoanLab can be used for a number of situations, but a few we recommend are:

- Sharing a scenario with colleagues to double check expected behavior.

- Share the scenario with Canopy when you have a question about the output or behavior.

- Save the URL to revisit later to validate consistent behavior.

- Use the sharable URL to pre-load a base timeline that you want to test multiple slight variations of.

Features Coming Soon

- Loan Restructuring

- Set SCRA

- Webhook Visibility

- MultiLoan

- Retroactive Actions

Updated 9 months ago